ON FRIDAY

SEPTEMBER 18, 2015

J

OINT

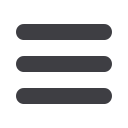

development project by the AspenGroup

and Ikano Retail Asia offers mixed development

AspenVision City. Spanning across 245 acres of

freehold land right in the centre of Batu Kawan,

this project is poised to become the next integrated

Central Business District of Penang, a thriving

metropolis that will boost growth in the northern

region even further.

Comprising amodernmix of residential and

commercial properties, AspenVision Citywill

offer a state-of-the-art regional shopping centre

whichwill include the very first Ikea in

Malaysia’s northern region. Another highlight

of the development will be a 25-acre Central

Island Park, not tomention the satellite city

supported by comprehensive infrastructure,

meticulously planned development

components, a strategic location and excellent

accessibility. Added AspenGroup CEODatuk

M. Murly (third from right): “Columbia Asia

Medical Centre will also be included …We

believe that all these andmore will be able to

create newvitality and vivacity, besides

spurting new commercial activities in this part

of the country.”

At the ground breaking ceremony for Aspen

Vision City, Penang chief minister LimGuan Eng (in

blue shirt) mentioned that this project development is

envisioned as ametropolis, considering the state

plans to amalgamate Batu Kawan and neighbouring

areas to become one established satellite city. Phase 1

is targeted for completion in 2018. For more, visit

aspenvisioncity.com.myAvision in themaking

X

FROM

PAGE 25

Email your feedback and queries to:

[email protected]X

sq ft whereas we aremade to

understand that recent launches

in the Golden Triangle area in KL

would average RM1,600 to RM1,800

per sq ft.”

Generally, there are no

restrictions to purchasing land held

under the “Country Lease”.

However, land held under “Native

Title (NT) are restricted to the

natives of Sabah only. NT land can

however, be sub-leased

to non-natives but for a period not

exceeding 30 years,” informs

Chung.

IT’S ALL ABOUT PERSPECTIVE

“Stringent financial borrowing

guidelines and other measures

taken by the government via its

financial institutions have also

eased speculative purchases. On the

positive side, these cooling

measures have resulted inmarket

corrections in some sectors,

preventing what could otherwise be

a runaway situation in terms of

market pricing and overhang,”

informs Ting.

In general, investment type

property in Sabah and Sarawak are

said to be comparatively new as

most properties are owner

occupied rather than purchased for

investment purposes. However,

times are changing says Ting.

“Good location, established areas

and areas with potential are still

worth investing.”

Chung, however, gives Sabah the

nod. “In terms of investment, where

long-termcapital gains and rent

returns are concerned, albeit

presently hardening yields with the

relatively steep rise in property

values over the past years.

However, most of the investment

interest would be focused in KK,

which is the administrative,

education, business and services

hub and themain gateway to Sabah

where themajority of the

population is centred. It is the focal

point for tourism, attracting people

for education, business and

employment opportunities, which

will drive demand for properties.”

His take on the Sabah outlook in

general: “For the near term… it

would be rather subdued given

present market conditions.”

As at the end of last year, the All

House Price Index for Sabah stood

at 295.6 points (up from 293.3 during

the same period the year before),

with residential and commercial

sub-sectors experiencing growth in

terms of value of 6.7% and 5.8%

respectively.

Reports claim that many projects

due for launch this year are put on

hold (eg. Tuaran’s shoppingmall) as

developers “watch andwait out” the

unsure development situation in the

country.

Nevertheless, ask property gurus

likeMilan Doshi and TanHwa

Chuan along withmany others who

will agree that the best time to buy

property is when others fear to do

so … “provided the location is good,

you can secure good financing and

you have negotiated yourself a

good deal!”