X

X

Please email your queries to us:

ON

friday

sept 27, 2013

By Rubini Kamalakaran

Contrary

to the rest of

UK, the London property

market has been benefiting

from the Global Financial

Crisis (GFC), especially in

recent years. The latest

report on the UK property

market shows a hike in

residential property prices,

to 9.7% in the last year. The

house prices which raced

passed their 2008 peaks, is

believed to be spurred by

high demand from foreign

investors for London

properties. A five year

forecast (2013 – 2017) onUK

property prices by estate

agents, Savills UK, shows

that London property prices

are generally expected to be

on the rise. Some of the

biggest players in London’s

propertymarket are the

Asians andMiddle Easterners.

Malaysia alone spent £1.4 billion

last year, snapping up City of

London offices. We’re the second

biggest foreign investor in London

commercial property after the US.

The biggest investment yet is the

£8 billion spent on the Battersea

Power Station, a re-development

project taken on by Sime Darby

Bhd, SP Setia Sdn Bhd and the

Employees Provident Fund under

the consortiumknown as

Battersea Power StationHolding

Co. In addition to those figures is

the growing number of Malaysians

snapping up London residences

annually.

Jazmine Goh, Director of Henry

Butcher Malaysia says from an

investment point, “London’s

appeal is allotted to it being a ‘very

safe and stable market’. Its

recovery since the global financial

crisis has been positive too.”

London versus UK

While the weak GBP is driving

major investment in London

property, the lure of the city never

ceases, in any economic weather.

This can’t be said for the rest of

UK. Goh confirms that “the rest

of UK behaves very different than

London.” Recent reports of the

widening divide of property

prices between London and the

rest of UK are telling. As one of

the greatest capitals in the world,

it’s a city steepedwith history,

firmly rooted in tradition, yet

modern. One can see reason as

Asians who share similar emphasis

on values and traditionwould be

inclined to London, judging from

many who are wiling to pay

premiumprices for one-bedroom

apartments in central London. The

bottom line for manyMalaysian

investors is that it makes sense to

invest in a London residence. In

many cases, they are parents with

children studying in London. Why

fork out rent everymonth when

one can invest money on an asset

that is almost guaranteed to yield

returns in the long run, questions

Henry Ng. He invested in a

three-bedroom apartment

just outside central

Londonwhere his two

daughters were studying.

Now that the youngest is

about to graduate, he’s

started looking into

renting. The latest report

on rental price in London

fromAugust 2012 to

August 2013 shows

growth between 2.7%

to 9.5%.

Pursuing Asian

Buyers

It’s no secret that foreign

buyers are sought after

by London property

developers. Weekend

London property

launches inmajor cities

in Asia like Hong Kong,

Singapore andMalaysia

has become a norm in the

recent years. Financial

Times quoted Tom

Rundall of Knight Frank

stating, “This whole

situation of selling

abroad has come about

because the banks

stopped lending andUK

buyers couldn’t get

mortgages, while Asian

propertymarkets were

still steaming ahead.”

The huge interest from

Asia has encouraged some

property developers in London to

consider Asian sensitivities

especially those of the Chinese,

like the number four for instance,

and the tendency to incorporate

feng shui aspects into their

property development blueprints.

Manhattan Loft Corporation CEO

Harry Handelsman admitted to

the Financial Times, of his

employing a feng shui master for

his developments. “I’mnot an

absolute believer in feng shui but if

millions of people believe in a

particular thing, then I don’t see

why we can’t try to accommodate

them,” he said. His new Stratford

development is designedwith

gaps in the walls to encourage the

flow of vital energy.

Though it seems like London

properties are in danger of being

majority-owned by foreigners, the

reality is 15% - 30%of a project is

allocated for local purchase per

UK government regulations.

Property developer Ballymore

recently revealed, at a media

briefing, of its latest project which

secured 60%of sales from local

buyers. Still, London property

launches in this region are not

looking to slowdown anytime

soon. Henry Butcher Malaysia

disclosed approximately eight

upcoming property launches in

the next three months.

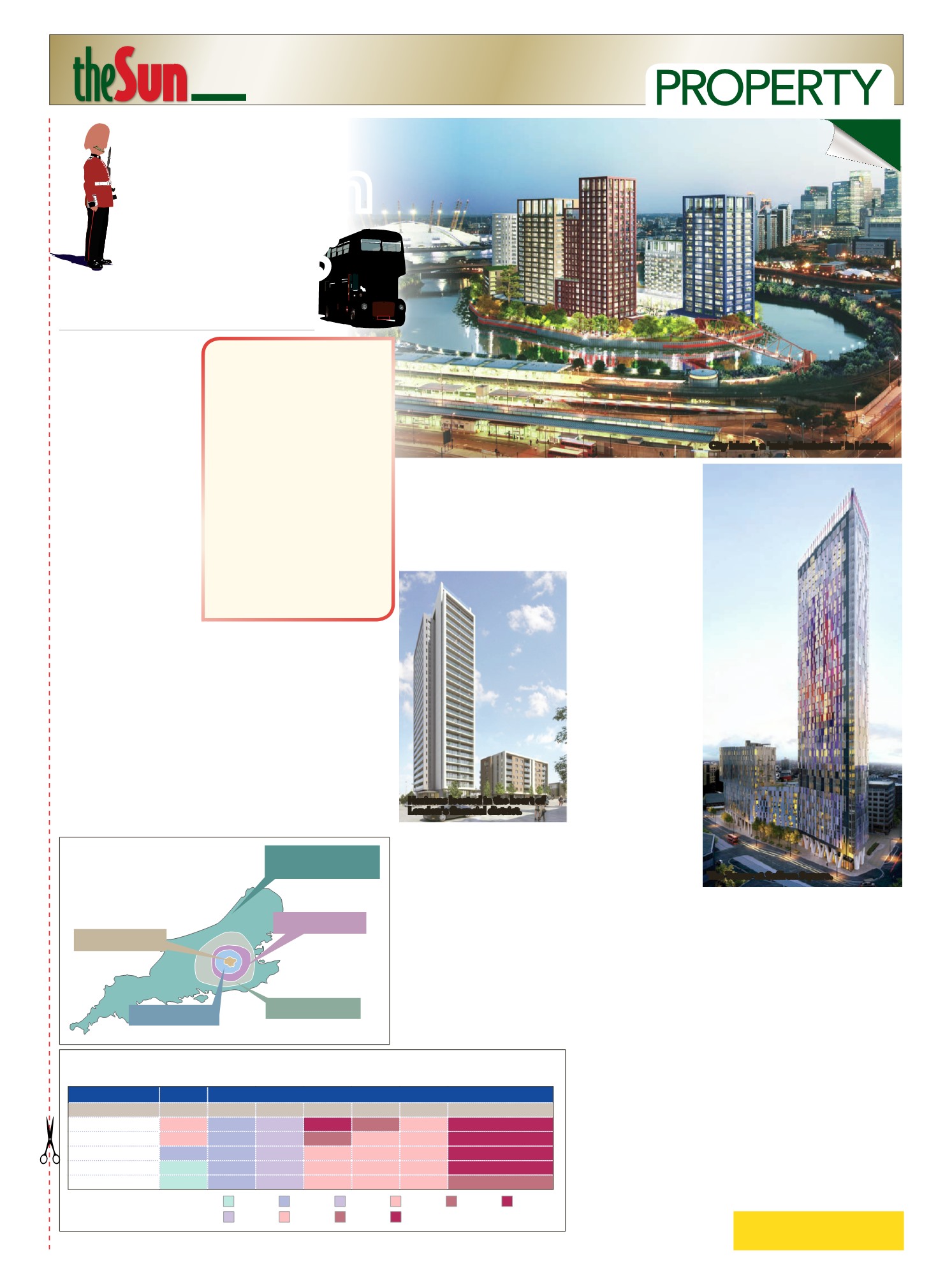

The latest projects to have been

presented include The Tower at

Saffron Square by UK’s Berkeley

Groupwhich is a 414 unit

development consisting of one,

two, three-bedroom apartments

and penthouses located at

Croydon; TelfordHomes’

Horizons, a 25-storey luxury

development that includes 131

private apartments in the heart of

London’s financial district; and

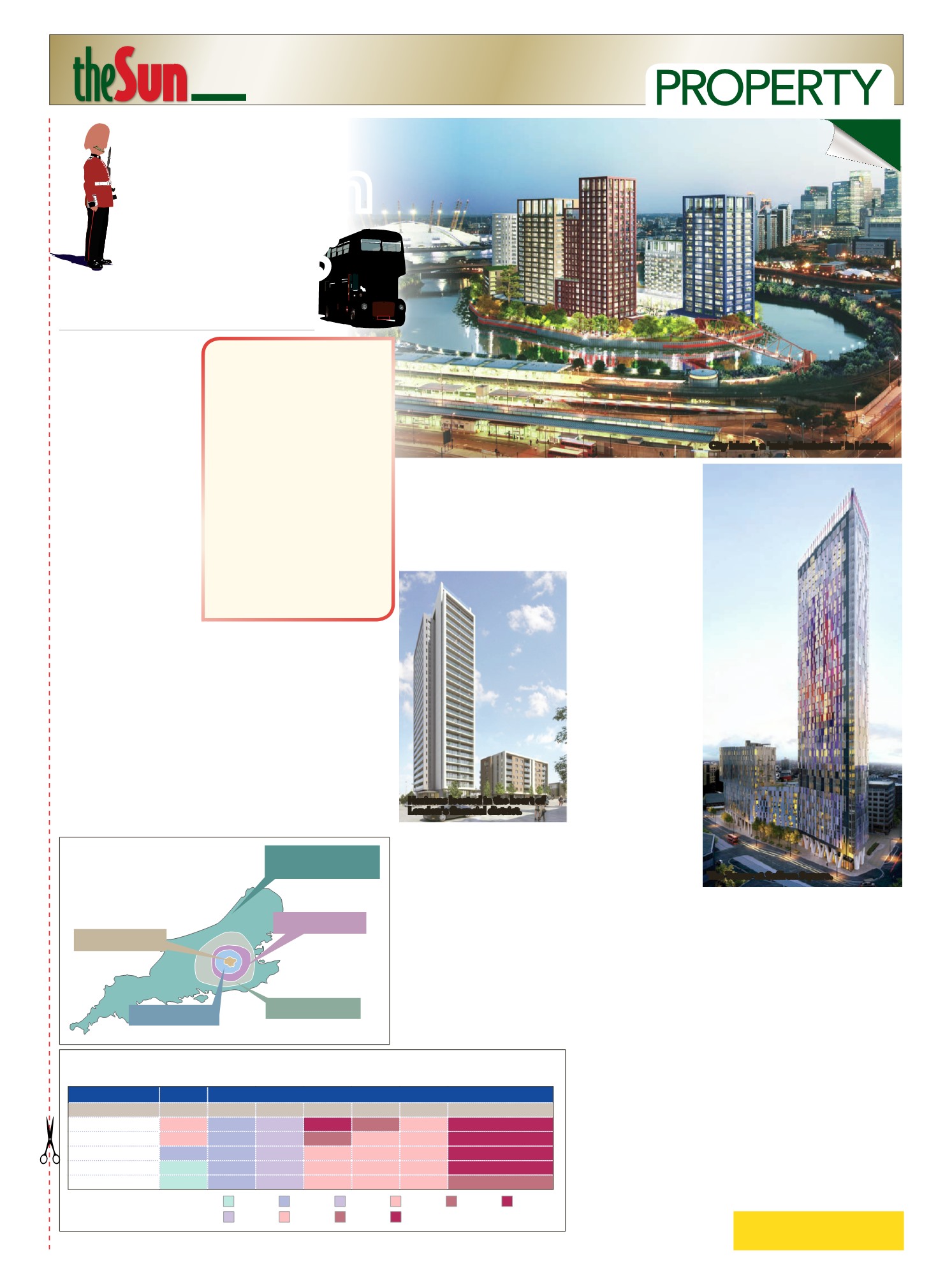

City Island, a project by Ballymore

that offers a unique new riverside

mixed development that aspires to

be a mini-Manhattan.

* Look out for the follow up

feature to this article next week,

on Malaysian property developers

with projects in London.

>Malaysiamakeswaves as amajor

player in the Londonproperty

market

City Island, a 'mini--Manhattan' in London.

The Tower at Saffron Square.

London

calling

Boroughs Expected To See

Most Growth in next 5 years

1. Westminister

2. Kensington and Chelsea

3. Hammersmith and Fulham

4. Camden

5. Islington

6. Hackney

7. Wandsworth

8. Southwark

9. Lambeth

10. Richmond upon Thames

11. Haringey

12. Brent

13. Barnet

14. Merton

15. Harrow

16. Ealing

17. Lewisham

18. Kingston upon Thames

19. Greenwich

20. Hounslow

Source: The Telegraph (Based on estate

agents, Savills UK, five year forecast of

property prices in London)

prime markets

Five-year forecast values

Annual house price growth key:

Five year house price growth key:

Below 0%

4% to 10%

0% to 2%

10% to 15%

2% to 4%

15% to 20%

4% to 6%

20% to 25%

6% to 8% 8% and over

ACTUAL

FORECAST

2012

2013

2014

2015

2016

2017

5 years to end 2017

Central London

5.3% 0.0% 3.5%

8.0% 6.5%

5.5%

25.6%

Outer Prime London

5.0% 0.0% 3.5%

6.5%

5.5% 5.0%

22.1%

Prime Suburbs

0.4% 1.0% 3.5% 5.5% 5.0% 5.5%

22.2%

Inner Commute

-0.1% 1.0% 3.5% 5.0% 5.0% 5.0%

21.0%

Outer Commute

-1.6% 0.0% 3.0% 4.5% 4.5% 5.5%

19.2%

Central London

Prime Suburbs

Outer Commute

Inner Commute

Wider South

of England

House Price Predictions

Source:

Horizons located in the heart of

London's financial district.

INSIGHTS

CUT AND KEEP